Why Dental Insurance Is Separate from Health Insurance — and What It Means for Monroe, NC Families

When it comes to health, most people assume their medical insurance will cover the essentials. But if you’ve ever tried to use your health plan for a dental cleaning, a filling, or even an emergency tooth extraction, you’ve probably been surprised (and frustrated) to learn that dental care is excluded from most health insurance policies.

It’s one of the oddest quirks in American healthcare: your teeth and gums are every bit as important as your heart, lungs, and eyes — yet dental care is carved out and treated as something separate. For families in Monroe, NC, where budgets are tight and dental problems can cause real hardship, this separation raises some important questions:

- Why aren’t teeth included in regular health insurance?

- How did this divide get started?

- What insurance should I buy to cover my family dental expenses?

- What do Medicare and Medicaid cover?

- And what options do you have if you’re trying to afford dental care in Union County?

Let’s explore the answers.

A Historical Divide: How Dentistry Got Left Out

The roots of this separation go back almost 200 years. In 1840, the first dental school in the United States — the Baltimore College of Dental Surgery — was founded. It wasn’t created as part of a medical school. In fact, it was formed only after physicians at the University of Maryland’s medical school refused to include dentistry in their program. That decision set the stage for decades of separation.

By the early 1900s, medicine and dentistry had already become two different professions, with different schools, licensing, and professional associations. Dentists were viewed less as “healthcare providers” and more as skilled craftsmen who focused on teeth. Meanwhile, medical doctors were handling everything else in the body.

When health insurance plans began to appear in the 1930s, they naturally followed this divide. Medical insurance was designed to protect people from sudden, catastrophic expenses like hospital stays, surgeries, or unexpected illnesses. (Medical insurance was first offered as a business perk for executives, but that’s a whole other blog unto itself!) Dentistry didn’t fit that model — most dental needs were routine and predictable (cleanings, fillings, extractions). As a result, dental insurance developed later, and in a completely separate system.

Why the Divide Still Exists

You might think that, by now, dental and medical insurance would have merged. But several factors keep them apart:

- Different Cost Structures

- Health insurance is built to cover unpredictable, high-cost events.

- Dental insurance is designed more like a “coupon plan,” covering predictable, low-cost care up to a yearly maximum (often $1,000–$2,000).

- Separate Business Models

Insurance companies typically run their medical and dental divisions separately. They use different networks, billing codes, and reimbursement rules. - Policy Decisions

When the Affordable Care Act (ACA) was passed in 2010, children’s dental coverage was included as an “essential health benefit.” But adult dental coverage was left optional. That decision reinforced the divide. - The Perception Problem

Many people still see dentistry as cosmetic or elective — whitening, braces, veneers. In reality, untreated gum disease is linked to diabetes, heart disease, and even pregnancy complications. But the old stigma lingers, and that affects how insurance companies treat it.

So, Let’s Talk About Your Dental Insurance Options for 2026

We did a quick search of the Best Dental Insurance Options for Families in North Carolina. You may find additional information and rates, but this is a good starting point if you are working on your family medical and insurance plans for 2026.

Here’s a look at some of the most highly recommended dental insurance options available in North Carolina, from wallet-friendly plans to more robust offerings.

Delta Dental of North Carolina

Why it stands out:

- Delta Dental offers one of the largest provider networks in North Carolina—about 31% larger than its closest competitor.

- It provides PPO, Premier, and combined PPO Plus Premier networks, giving members flexibility and wide access to dentists.

- The company is well-established with more than 60 years of experience, high customer satisfaction, and nearly 100% claim accuracy within 15 days, making it reliable and efficient.

Plan offerings in 2025:

- Preventive Plan (~$30/month): 100% preventive coverage, 50% basic services, no orthodontics, $1,000 annual max.

- Enhanced Plan (~$45/month): 100% preventive, 70% basic, 50% major services, no ortho, $1,000 annual max.

- Premium Plan (~$67/month): 100% preventive, 80% basic, 50% major services, 50% orthodontics, $1,500 annual max.

Why it’s strong:

These plans provide meaningful coverage while remaining accessible—a solid fit for families needing regular care and flexibility.

Blue Cross NC – Dental Blue® for Individuals

Blue Cross NC offers three tiered PPO plans through the Dental Blue® suite:

- Preventive PPO Plan: Lowest premiums, covers routine care.

- Core 1000 Plan: Affordable, comprehensive coverage; allows visiting any dentist.

- Value 1500 PPO Plan: Higher premiums but strong in-network benefits for preventive, basic, and major services. (Source: Blue Cross NC)

All plans include:

- Two checkups and cleanings per benefit period.

- No deductible on preventive care (when in-network).

Claims handled for you and a broad North Carolina provider network. (Source: Blue Cross NC)

Stand-Alone Marketplace Dental Plans

There are several dental insurance providers offering plans via the federal Marketplace for North Carolina, typically available during open enrollment or qualifying life events:

- Providers include BEST Life, Delta Dental of NC, Dominion National, EMI Health, Guardian, Humana, and TruAssure. (Source: Healthinsurance.org)

Additional Options Worth Noting

Beyond traditional dental insurance, North Carolina residents can explore:

Spirit Dental & Vision

- Offers no waiting periods, a $100 lifetime deductible, and up to $5,000 max coverage by year 3.

- Includes both dental and vision coverage—ideal for families looking for bundled benefits.

Humana and Aetna PPO Plans

- Humana Smart Choice Dental Plans often combine dental, vision, and hearing; may offer no waiting periods and solid preventive coverage. (Source: Investopedia)

- Aetna Dental Direct Preferred PPO offers flexibility with out-of-network coverage, reasonable premiums (starting around $30/month), and a typical annual maximum of around $1,250. (Source: Delta Plans)

Choosing the Right Plan: What to Look For

Based on expert sources, here are key factors families should weigh when selecting a dental plan. (Source: Investopedia)

- Type of Plan (PPO vs. HMO vs. Discount)

- PPOs offer broader dentist options—including out-of-network—but may cost more.

- HMOs/DHMO (e.g., DeltaCare® USA) generally cost less but restrict you to in-network providers. (Source: Delta Dental, Wikipedia)

- Dental discount plans offer discounted fees (10–60%) rather than reimbursements—useful when traditional insurance isn’t viable. (Source: Wikipedia)

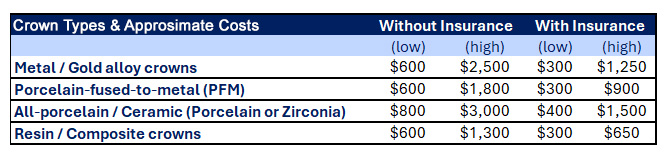

- Cost Breakdown

- Compare monthly premiums, deductibles, co-insurance percentages, and annual maximum benefits (usually $1,000–$2,000). (Source: Forbes, Investopedia)

- Access to Providers

- Ensure your preferred dentist accepts the plan; Delta Dental and Blue Cross have extensive networks in NC. (Source: Delta Dental Inc., Blue Cross NC, Reddit)

- Waiting Periods

- Many plans require waiting periods before covering basic or major care—something to review closely. (Source: Forbes, Delta Dental Inc., Investopedia).

- Extra Coverage

- Does the plan cover orthodontics, implants, dentures, or cosmetic treatments? For example, Delta Dental’s PPO Premier plan offers 50% coverage on implants/dentures and orthodontics after six months. (Source: Forbes)

Here’s a quick comparison table to help families in Monroe evaluate options:

| Provider | Highlights |

| Delta Dental of NC | Massive network, robust plans (Preventive, Enhanced, Premium), flexible |

| Blue Cross NC (Dental Blue) | Tiered PPO plans, no preventive deductible, easy claims handling |

| Marketplace Plans (e.g., Humana, Guardian) |

Stand-alone options via ACA marketplace |

| Spirit Dental & Vision | No waiting periods, combo dental + vision coverage, growing max benefit |

| Aetna PPO / Humana | Moderate cost, some combined coverage, flexible network access |

What Medicare Covers (and What It Doesn’t)

If you’re approaching retirement age in Monroe, you may be shocked to learn that Medicare does not cover most routine dental care.

- Original Medicare (Parts A & B)

Covers hospital stays, doctor visits, and preventive screenings — but not dental cleanings, fillings, dentures, or implants. The only time Medicare steps in is if you need dental treatment as part of another covered medical procedure (for example, a jaw surgery after an accident). - Medicare Advantage (Part C)

Many Advantage plans include dental benefits, but coverage can be limited. Some cover two cleanings a year and basic X-rays. Others may contribute toward crowns, dentures, or implants — but with strict annual limits.

For seniors on fixed incomes in Monroe, this lack of coverage often means delaying care until a dental problem becomes a crisis. Unfortunately, waiting can turn a small cavity into an emergency root canal or extraction — which costs far more in the long run.

What Medicaid Covers in North Carolina

Medicaid is a lifeline for many families in Union County. But when it comes to dental care, coverage depends heavily on age and circumstance.

- Children under 21

Medicaid covers a broad range of dental services, including checkups, cleanings, fillings, and sometimes orthodontics if medically necessary. - Adults

North Carolina Medicaid does provide some adult dental benefits — but they are limited. As of 2025, coverage includes preventive care (exams, X-rays, cleanings), basic restorative care (fillings, some extractions), and dentures in certain cases. More complex procedures like crowns, bridges, or implants are often not covered.

The other challenge? Access. Even if you qualify for Medicaid, not every dentist in Monroe accepts it. Low reimbursement rates mean that some practices can’t afford to participate. That leaves patients with fewer options, and longer wait times.

The Human Impact of the Dental Divide

At first glance, separating dental and medical insurance might look like a technical issue. But here in Monroe, it has very real consequences:

- Higher Emergency Room Visits

People without dental insurance often wait until pain becomes unbearable. They head to the ER, where they might get painkillers or antibiotics — but not the dental treatment they actually need. - Missed Work and School

Toothaches and infections cause children to miss school and adults to miss work shifts. For families already on tight budgets, the ripple effect is enormous. - Worsening Health

Gum disease and untreated infections can make chronic conditions like diabetes and heart disease harder to manage. Oral health isn’t just about a smile — it’s tied to the whole body. - Stigma and Confidence

Missing teeth or visible decay can affect self-esteem, job interviews, and social interactions. In a small town like Monroe, where community connections matter, that can be devastating.

What Monroe Families Can Do

So what can you do if you’re trying to manage dental costs without great insurance coverage? Here are some practical steps:

- Look Into Medicare Advantage

If you’re over 65, compare Advantage plans carefully during open enrollment. Some may offer better dental benefits than others, and the differences can be huge. - Check Your Medicaid Status

If you qualify for Medicaid in North Carolina, confirm which dental benefits you’re eligible for — and call ahead to ask if your dentist accepts it. - Focus on Prevention

Brushing, flossing, and regular checkups are still the cheapest way to avoid major costs later. Catching problems early almost always saves money. - Explore Community Resources

Union County sometimes offers free or reduced-cost dental clinics through nonprofits or local health departments. Keep an eye on community announcements, especially for back-to-school events.

Why It’s Time to Rethink Dental Coverage

While the system may be slow to change, awareness is growing. Medical researchers now recognize the strong link between oral health and overall health. Advocacy groups are pushing for expanded Medicaid dental benefits and for Medicare to cover more routine dental care.

For families in Monroe, that change can’t come soon enough. In the meantime, being proactive — asking questions, exploring local options, and keeping up with preventive care — is the best defense against a system that wasn’t built with teeth in mind.

Final Thoughts

It’s frustrating that teeth, gums, and mouths — such critical parts of our health — are left out of most health insurance plans. But by understanding why this separation exists, what’s covered by Dental Insurance, Medicare and Medicaid, and what options are available locally in Monroe, NC, you can make smarter choices for yourself and your family.

Dental health isn’t just about a pretty smile. It’s about confidence, dignity, and protecting your whole-body health. And even in a system that hasn’t caught up yet, you do have ways to get the care you need.

If you have questions about dental insurance, coverage, or affordable options for your family, contact Adam Brown, DDS in Monroe today. We’re here to help you navigate your choices and keep your smile healthy — no matter what your insurance situation looks like.